- Humbled Trader

- Posts

- Broadening Rally Meets Overbought Signals- Weekend Watchlist

Broadening Rally Meets Overbought Signals- Weekend Watchlist

Broad participation continues — but near-term caution is rising.

Markets remained range-bound at the index level, but rotation continued beneath the surface. While the S&P 500 and Nasdaq slipped slightly, small caps and equal-weight stocks outperformed, confirming the ongoing broadening trade. Weakness in mega-cap tech and software—driven by AI disruption fears—contrasted with renewed strength in semiconductors after solid earnings from Taiwan Semiconductor.

Macro data reinforced a firm but sticky economic backdrop: inflation cooled modestly, consumer spending stayed resilient, jobless claims remained low, and Q4 GDP expectations moved higher. In short, leadership rotated—but the bull trend didn’t break.

TLDR Stock Market Weekly Update - January 23, 2026

📊 Technical Levels & Market Signals

S&P 500 (SPX): Continues to outperform cap-weighted indices

Holding above recent breakout levels

Confirms ongoing broadening participation

💰 Economic Data, Rates & the Fed

CPI: Core inflation cooled slightly; headline steady

PPI: Annual readings still warm → inflation not accelerating, but sticky

Retail Sales: Beat expectations; consumer remains resilient

Jobless Claims: Near cycle lows

GDPNow (Q4): Revised higher to ~5.3%

Treasury yields drifted higher, flattening the curve modestly. As a result, rate-cut probabilities for 2026 continued to decline, with March and April odds easing further.

Sources: Charles Schwab

📅 Coming up next week…

Economic Events:

Wed (Jan 28): Housing Starts, Building Permits, Pending Home Sales

Thu (Jan 29): GDP (Revised), PCE Inflation, Personal Income & Spending, Jobless Claims

Fri (Jan 30): University of Michigan Consumer Sentiment

Notable Earnings Reports:

Tue (Jan 27): UPS, BA, GM, RTX, AAL

Wed (Jan 28): ASML, SBUX, MSFT, META, TSLA

Thu (Jan 29): MA, AAPL, V

Fri (Jan 30): SOFI

Sources: Earnings Whispers, Charles Schwab

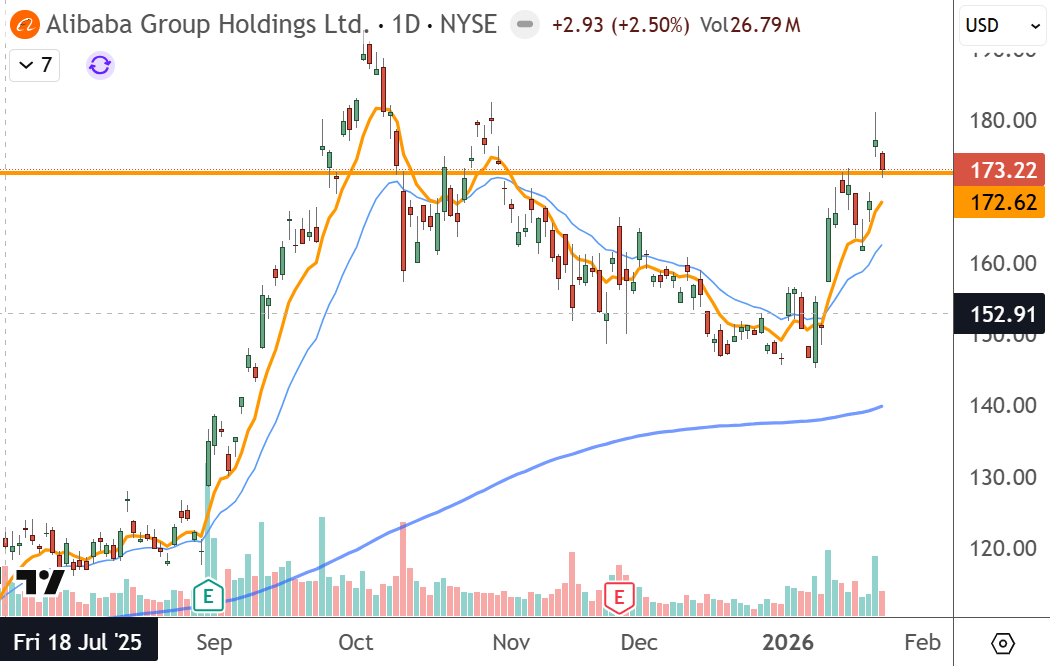

| BABA $173.22

|

| LMND $93.25

|

| CRML $20.62

|

🗞️ Market movers you might’ve missed:

- $BABA: Alibaba's (BABA) AI Chip Unit Takes Aim at Nvidia (NVDA) as IPO Talk Gathers Pace.

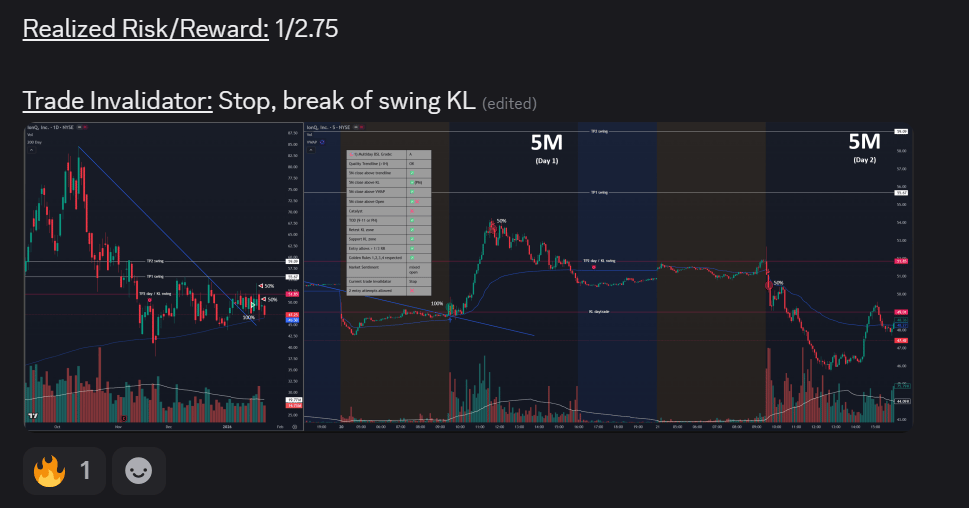

- How we traded: Backside Long Strategy

- $ARM: Arm Holdings Stock Jumps As Analyst Flags Significant Upside

- How we traded: Backside Long Strategy

Ready to Elevate Your Trading this year?

Check out the Humbled Trader community!

Trade alongside and engage in market discussions with like-minded traders, and learn from our team of experienced trading coaches.

Your success story could be featured in one of our next “Top Trades of the Week” showcases! Learn more about our community and what we offer by clicking the button below.

Our Recommended Trading Tools:

Premium broker for large accounts: Centerpoint Securities

Best overall trading broker: Interactive Brokers

Best web-based charting platform: TradingView

Best scanner for active traders: Trade Ideas (Download my settings)

Not sure how to select a tool that fit your needs? Reply to this email with your trading style, and we will be happy to help!

Email Disclaimer:

The Watchlist Emails are NOT trade alerts to buy or sell. We are not financial advisers. The above information is for educational and entertainment purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. We are merely sharing our opinion with no guarantee of gains or losses on investments. You accept our Terms and Conditions.