- Humbled Trader

- Posts

- Gold Rallies, Fed Chair Named, Memory Stocks Lead- Weekend Watchlist

Gold Rallies, Fed Chair Named, Memory Stocks Lead- Weekend Watchlist

Policy shifts and earnings dispersion drive a volatile trading week.

Markets delivered on last week’s “Higher Volatility” forecast, even though headline index performance finished flat to slightly positive. Stocks rallied early in the week before giving back gains in the back half, masking sharp intra-week swings.

Volatility picked up meaningfully, with the VIX briefly nearing 20, driven by tech earnings dispersion. META surged nearly 10% while MSFT fell almost as much. ServiceNow dropped ~10% post-earnings despite a beat-and-raise quarter, while memory and storage stocks (SanDisk, Seagate, Western Digital) rallied on strong guidance. Earnings overall remained solid: 79% of S&P 500 companies beat EPS, with earnings growth tracking above 15% YoY so far this season.

The Fed held rates steady, while markets digested news that Kevin Warsh has been nominated as the next Fed Chair, adding uncertainty around future policy.

TLDR Stock Market Weekly Update - Feb 1, 2026

📊 Technical Levels & Market Signals

Nasdaq 100 (NDX): Recently hit three-month highs but rolled over post-earnings. A bounce off the 50-day SMA failed to hold.

Bias: Neutral to cautious.Russell 2000 (RUT): Down ~2% on the week as the rotation trade unwound. RSI slipped below 50 and MACD turned bearish.

Bias: Cautious; potential test of 50-day SMA.Market Breadth: Contracted, especially in tech-heavy indices, reflecting post-earnings pressure in mega caps.

💰 Economic Data, Rates & the Fed

FOMC: Rates unchanged; policy described as “appropriate” given firm growth.

PPI: Hotter than expected, signaling sticky inflation pressures.

Consumer Confidence: Fell to a 10-year low.

Chicago PMI: Jumped to 54.0, first expansion reading in over two years.

Treasury Yields: Curve steepened modestly; 10-year pushed toward 4.25%.

Rate Cut Odds: Slightly increased following Fed meeting and Warsh nomination.

🏛️ Cryptocurrency Update

Bitcoin fell into the low $80Ks amid rising shutdown risk and uncertainty about Fed leadership. Unlike prior shutdown periods, positioning appears less stretched, which may limit downside. Ongoing balance sheet expansion by the Fed could provide longer-term support.

Sources: Charles Schwab

📅 Coming up next week…

Economic Events:

Wed (Jan 28): Housing Starts, Building Permits, Pending Home Sales

Thu (Jan 29): GDP (Revised), PCE Inflation, Personal Income & Spending, Jobless Claims

Fri (Jan 30): University of Michigan Consumer Sentiment

Notable Earnings Reports:

Mon (Feb 2): DIS, PLTR, SPG

Tue (Feb 3): PYPL, PEP, AMD, SMCI, CMG

Wed (Feb 4): UBER, GOOGL, ARM, SNAP, QCOM

Thu (Feb 5): AMZN, RDDT, BE, AFRM, MSTR, RBLX

Sources: Earnings Whispers, Charles Schwab

| WDC $250.23

|

| SNDK $576.25

|

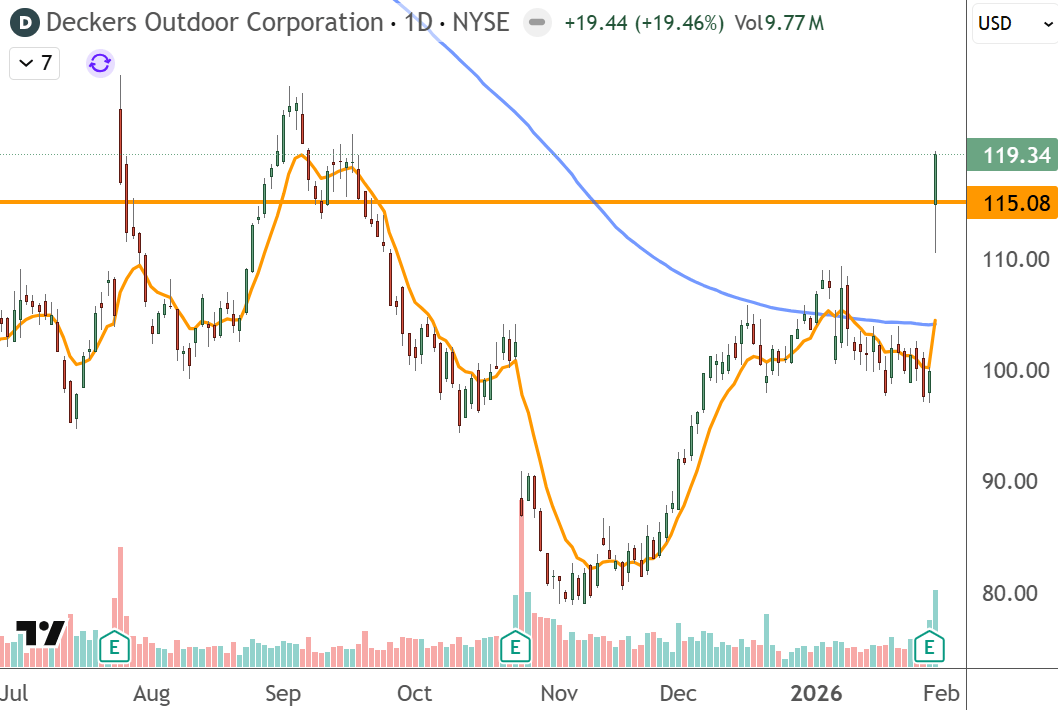

| DECK $119.34

|

🗞️ Market movers you might’ve missed:

- $SNDK: Sandisk shares are trading higher after the company reported better-than-expected Q2 financial results and issued Q3 guidance above estimates.

- How we traded: Daily Extension Short

- $RCL: Royal Caribbean Cruises shares are trading higher after the company reported Q4 financial results and issued Q1 and FY26 adjusted EPS guidance above estimates.

- How we traded: Gap Up Reversal Long

Ready to Elevate Your Trading this year?

Check out the Humbled Trader community!

Trade alongside and engage in market discussions with like-minded traders, and learn from our team of experienced trading coaches.

Your success story could be featured in one of our next “Top Trades of the Week” showcases! Learn more about our community and what we offer by clicking the button below.

Email Disclaimer:

The Watchlist Emails are NOT trade alerts to buy or sell. We are not financial advisers. The above information is for educational and entertainment purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. We are merely sharing our opinion with no guarantee of gains or losses on investments. You accept our Terms and Conditions.