- Humbled Trader

- Posts

- Markets at a Crossroads: Rotation Strength vs. Tech Weakness

Markets at a Crossroads: Rotation Strength vs. Tech Weakness

The rotation trade continues — but overbought signals are flashing.

🚀 Featured Broker: Centerpoint Securities

My travel trading setup: Centerpoint Securities + DAS Trader Pro

Shoutout to the broker I use daily for trading

I've used them for years—they’re fast, reliable, and built for pros who need fast execution.

Here’s their new year promo:

FREE commissions for 90 days

FREE DAS Trader platform for 3 months ($360 value)

50% Off commissions for life!

Get $7,500+ in tools free (Trade Ideas, Dilution Tracker & more!)

Available in US, Canada & International

If you’re ready to level up your trading, check them out below!

Markets continued to show clear rotation rather than broad index strength. While the S&P 500 and Nasdaq finished slightly lower on the week, small caps and equal-weight stocks outperformed, confirming that the “rotation trade” remains the dominant theme. The Russell 2000 gained roughly +2.4%, while the S&P Equal Weight Index rose about +0.8%, signaling continued participation beyond mega-cap tech.

Technology leadership further fractured. Large-cap software stocks saw heavy selling, with several names hitting fresh 52-week lows amid concerns that AI platforms could disrupt traditional software business models. In contrast, semiconductors and AI infrastructure names held up better, supported by a strong earnings report from Taiwan Semiconductor. Meanwhile, economic data largely reinforced the view of a resilient U.S. economy, with strong retail sales, firm housing data, low jobless claims, and a sharply higher Q4 GDP tracking estimate.

TLDR Stock Market Weekly Update - Jan 16, 2026

📉 Market Trends

Rotation Still Alive: Capital continues to flow into small caps and equal-weight stocks, even as mega-cap indices consolidate.

Tech Leadership Splits: Software stocks weaken while semis and AI infrastructure remain supported.

Economic Resilience: Consumer spending, housing, and labor data point to continued economic strength.

💰 Economic Data, Rates & the Fed

Inflation: CPI and core CPI came in slightly cooler than expected; PPI annual readings remain sticky.

Growth: Retail sales beat estimates and the Atlanta Fed raised Q4 GDP tracking to 5.3%, reinforcing growth momentum.

Rates: Treasury yields drifted higher, with the 10-year testing the 4.20–4.25% zone—an important level for risk assets.

Fed Expectations: Market pricing for near-term rate cuts continued to decline following firm economic data.

🏛️ Cryptocurrency News

Crypto momentum cooled after progress on the Clarity Act stalled. Coinbase’s CEO withdrew support, citing unfavorable amendments.

Debate continues around stablecoins, bank competition, and regulatory clarity, suggesting policy uncertainty remains a headwind near term.

Sources: Charles Schwab

📅 Coming up next week…

Economic Events:

Wed (1/21): Housing Starts, Building Permits, Construction Spending, MBA Mortgage Applications, Pending Home Sales

Thu (1/22): Initial Jobless Claims, Continuing Claims, Q3 GDP (3rd Estimate), PCE Prices (Fed’s preferred inflation gauge), Personal Income & Spending, EIA Crude Oil & Natural Gas Inventories

Fri (1/23): University of Michigan Consumer Sentiment (Final)

Notable Earnings Reports:

Tue (1/20): MMM, UAL, IBKR, NFLX, FAST

Wed (1/21): JNJ, SCHW

Thu (1/22): INTC, GE, PG

Fri (1/23): SLB

Sources: Earnings Whispers, Charles Schwab

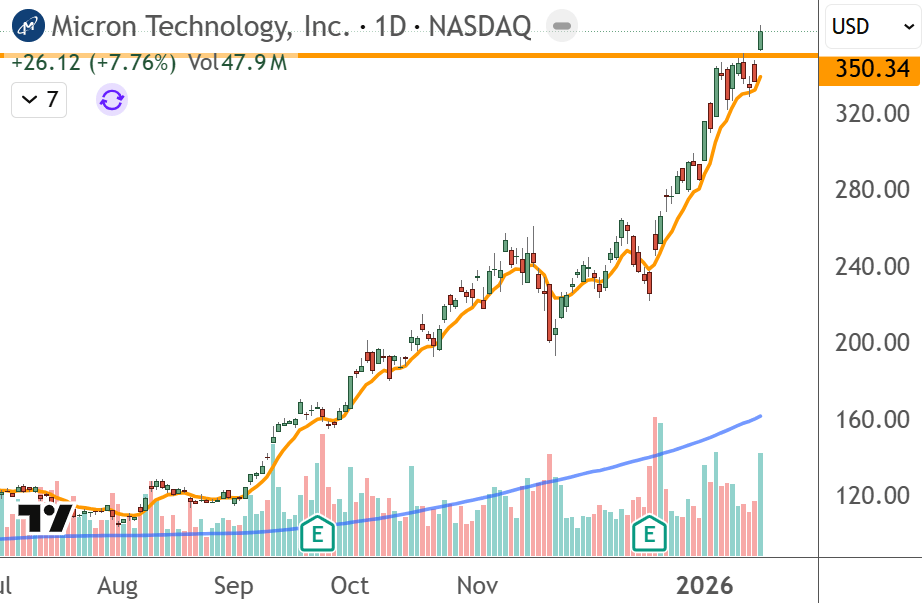

| MU $363.07

|

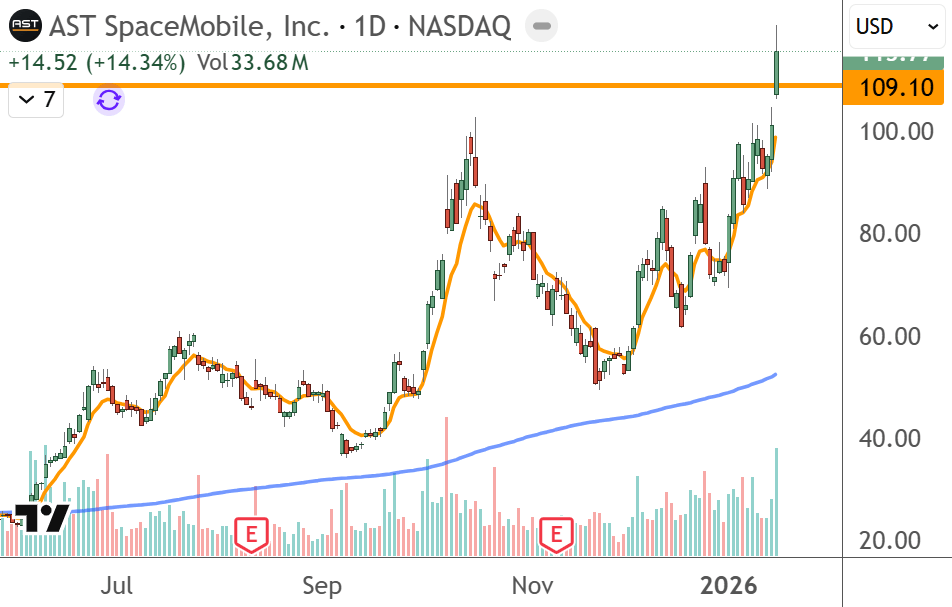

| ASTS $115.77

|

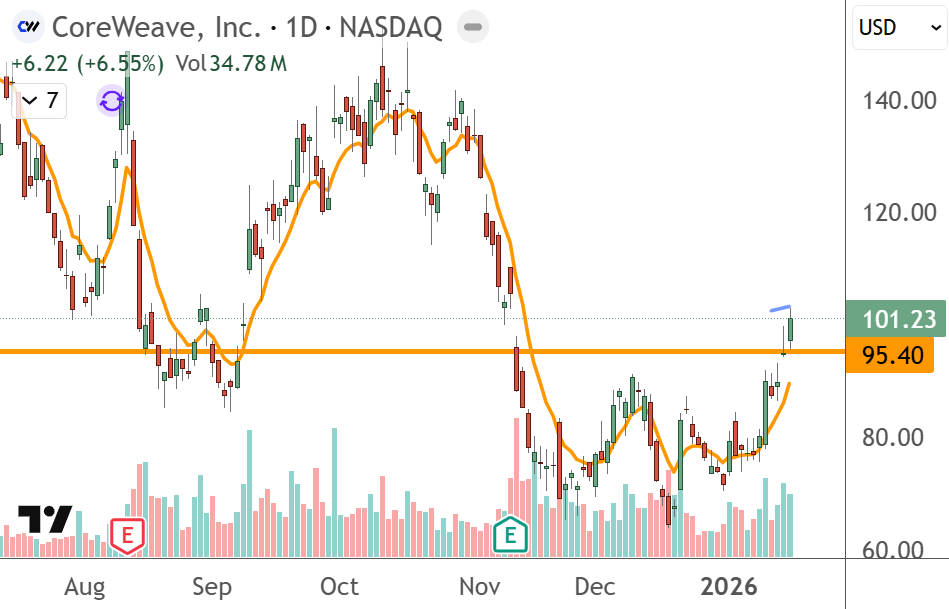

| CRWV $101.23

|

🗞️ Market movers you might’ve missed:

- AST SpaceMobile Inc ($ASTS) AST SpaceMobile shares are trading higher after the company was awarded a prime contract position on the US Missile Defense Agency's SHIELD program.

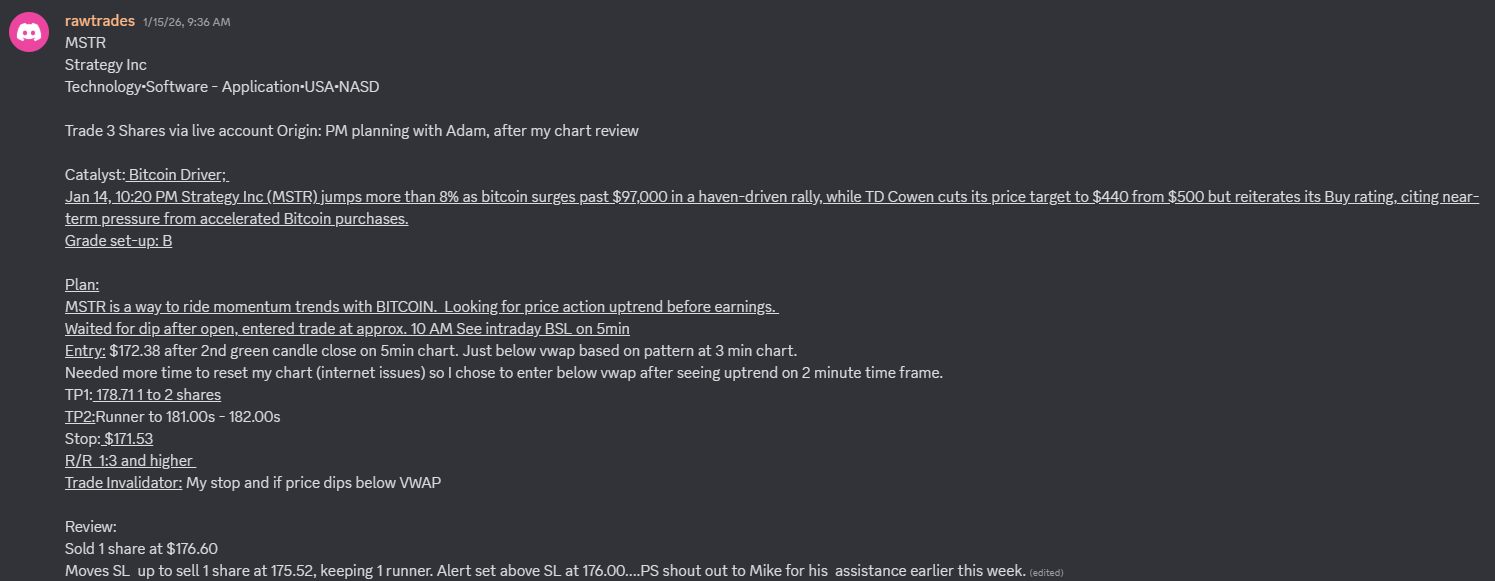

- How we traded: Gap Up Reversal Long Strategy

- Taiwan Semiconductor Manufacturing Company Limited ($TSM) Taiwan Semiconductor Manufacturing shares are trading higher after the company reported fourth-quarter earnings and revenue that beat analyst estimates.

- How we traded: Trend Join Long Strategy

Ready to Elevate Your Trading this year?

Check out the Humbled Trader community!

Trade alongside and engage in market discussions with like-minded traders, and learn from our team of experienced trading coaches.

Your success story could be featured in one of our next “Top Trades of the Week” showcases! Learn more about our community and what we offer by clicking the button below.

Email Disclaimer:

The Watchlist Emails are NOT trade alerts to buy or sell. We are not financial advisers. The above information is for educational and entertainment purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. We are merely sharing our opinion with no guarantee of gains or losses on investments. You accept our Terms and Conditions.