- Humbled Trader

- Posts

- Riding the Melt-Up: Tech Surges as Earnings Impress- Weekend Watchlist

Riding the Melt-Up: Tech Surges as Earnings Impress- Weekend Watchlist

Humbled Trader's day trading & swing trading ideas

Markets cruised higher this week, with the S&P 500 and Nasdaq Composite reaching fresh all-time highs—despite last week’s “Slightly Bearish” forecast proving incorrect.

Strong Q2 earnings and trade developments with Japan supported the rally: auto tariffs were cut from 27.5% to 15% and Japan agreed to invest $550B in the U.S. Alphabet and GE Vernova beat expectations—Alphabet also pledged $10B in AI capex—and Nvidia surged to new highs after resuming AI chip sales to China following a meeting between CEO Jensen Huang and President Trump.

Tech strength lifted semis and broader indices, even as concerns around momentum and absence of bearish reversal patterns lingered. Trump also toured the Fed and hinted at rate pressure on Chair Powell, though market impact was minimal.

TLDR Stock Market Weekly Update - July 25, 2025

📉 Market Trends

Macro-Tailwinds: Strong corporate beat rates—67% topping revenue, 83% bottom line—sent Q2 growth to 4.76% (revenue), 8.29% (EPS).

Trade Euphoria: Japan reduced tariffs and committed investment; talks with the EU underway.

Tech & Semis Lead: Nvidia, Alphabet and other tech names fueled market momentum.

📊 Technical Levels & Market Signals

S&P 500 (SPX): While in long-term uptrend, RSI near 76 signals overbought conditions. No bearish reversal patterns yet —short-term stance: Neutral.

Nasdaq Composite (COMP): New all-time highs confirmed by rising RSI—bullish but overextended. Sentiment: Slightly Bullish.

Breadth: S&P breadth expanded to 66%, signaling broader participation; Nasdaq and Russell remained flat

💰 Economic Data, Rates & the Fed

CPI & PPI: Latest data showed mixed signals (modest inflation, flat core PPI) but cohesive view of moderate price pressure—details in earlier economic summary.

Jobs: Labor market remains stable and strong.

Fed Outlook: FOMC next week unlikely to cut rates; Trump toured Fed headquarters, but rate policy remains unchanged for now.

Fed Cut Odds: Market sees near-zero chance of July cut; September cut expectations now at ~69%

🏛️ Cryptocurrency News

Bitcoin’s flat week came after reaching record highs early in July—momentum paused after Trump signed crypto legislation (GENIUS Act). Crypto-related equities pulled back ~1–2%.

Institutional adoption ticks up—JPMorgan exploring crypto-backed loans; Goldman Sachs eyes tokenized money market funds with blockchain settlement.

Sources: Charles Schwab

📅 Coming up next week…

Economic Events:

Mon (7/28): No reports

Tue (7/29): International Trade in Goods, Retail & Wholesale Inventories, Consumer Confidence, Housing Price Indexes

Wed (7/30): FOMC Decision, ADP Employment, GDP (advanced), Crude Oil Inventories, Home Sales

Thu (7/31): Personal Income & Spending, PCE Prices, Employment Cost Index, Jobless Claims, PMI indexes

Fri (8/1): Nonfarm Payrolls, ISM Manufacturing PMI, UMich Sentiment, Workweek, Hourly Earnings

Notable Earnings Reports:

Tue (7/29): BA, V, SOFI, PYPL, SBUX, BKNG

Wed (7/30): ETSY, QCOM, ARM, MSFT,META, INTC, HOOD

Thu (7/31): AAPL AMZN, COIN, RDDT, ROKU, CVS, MA

Fri (8/1): XOM, CVS

Sources: Earnings Whispers, Charles Schwab

| VRSN #

|

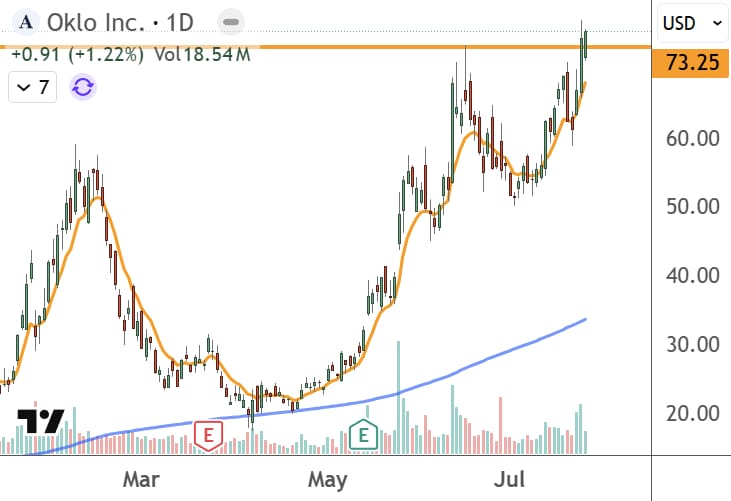

| OKLO $73.25

|

| NKE $76.27

|

🗞️ Market movers you might’ve missed:

- Microsoft Corp ($MSFT) Wedbush Reiterates Outperform on Microsoft, Maintains $600 Price Target

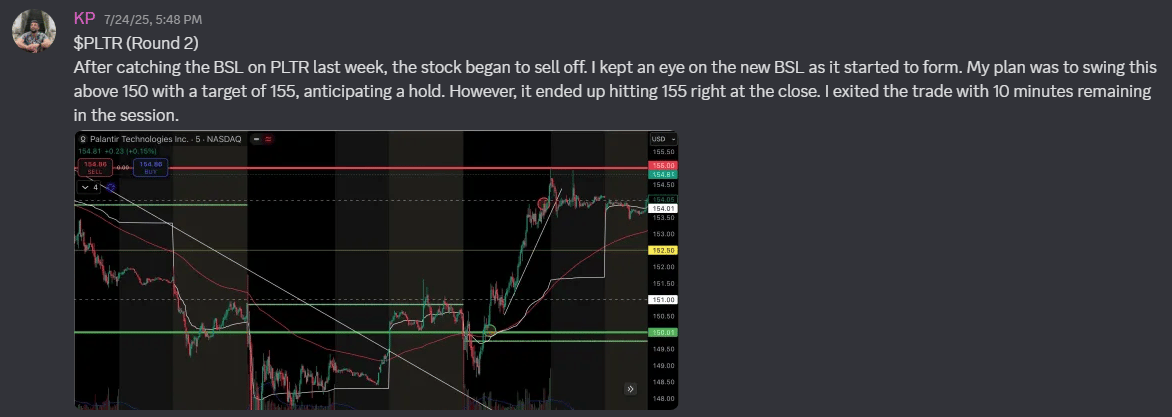

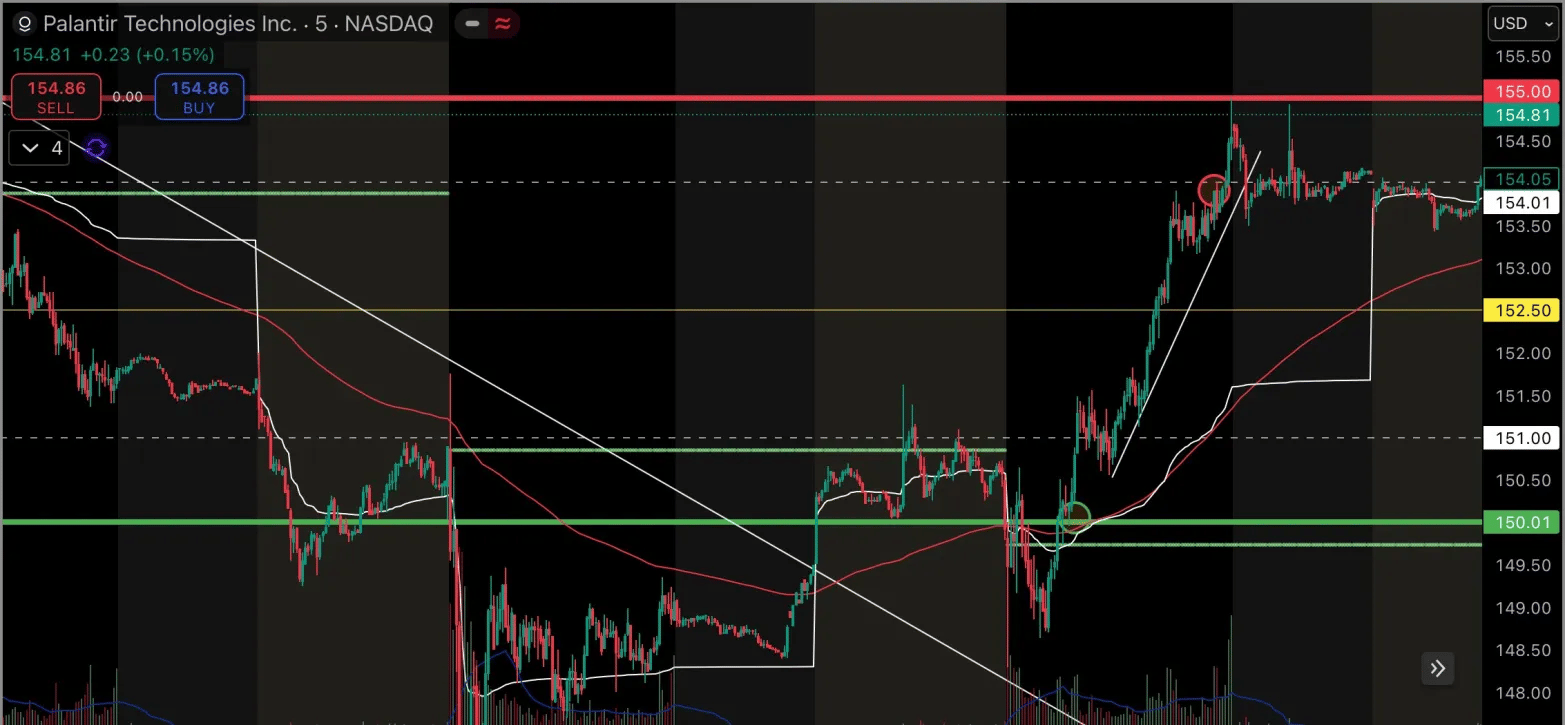

- How we traded: Backside Long Strategy

- Alphabet Inc Class A. ($GOOGL) Alphabet Q2 Earnings: Revenue, EPS Beat Estimates, Google Parent Raises CapEx Outlook Due To 'Strong And Growing' Cloud Demand.

- How we traded: Gap Up Reversal Long Strategy

Ready to Elevate Your Trading this year?

Check out the Humbled Trader community!

Trade alongside and engage in market discussions with like-minded traders, and learn from our team of experienced trading coaches.

Your success story could be featured in one of our next “Top Trades of the Week” showcases! Learn more about our community and what we offer by clicking the button below.

Our Recommended Trading Tools:

Premium broker for large accounts: Centerpoint Securities

Best overall trading broker: Interactive Brokers

Best web-based charting platform: Tradingview

Best trading journal with backtesting: Tradezella

Not sure how to select a tool that fit your needs? Reply to this email with your trading style, and we will be happy to help!

Email Disclaimer:

The Watchlist Emails are NOT trade alerts to buy or sell. We are not financial advisers. The above information is for educational and entertainment purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. We are merely sharing our opinion with no guarantee of gains or losses on investments. You accept our Terms and Conditions.