- Humbled Trader

- Posts

- S&P 500 Hits New Records: Bulls Ignore Shutdown, Tech Looks Tired- Weekend Watchlist

S&P 500 Hits New Records: Bulls Ignore Shutdown, Tech Looks Tired- Weekend Watchlist

Humbled Trader's day trading & swing trading ideas

Hi !

Want to learn how to start trading as a side hustle?

I’ll be sharing pro tips and guiding you on how to get started trading part-time in an upcoming live webinar (for FREE), hosted by TD Direct Investing.

Date: Thursday, Oct 9, 2:00 pm ET

There will also be a Q&A, so make sure to bring any questions you may have. See you soon :) !

Markets surged to fresh all-time highs this week, with the S&P 500 up nearly 2%, defying the ongoing U.S. government shutdown. The rally was powered by seasonal tailwinds, strong fund inflows, falling Treasury yields, and optimism ahead of Q3 earnings season. The AI infrastructure theme stayed front-and-center, though some late-week weakness hit big tech and semiconductors as traders locked in profits.

Economic data was limited due to the shutdown, but the ADP report showed the largest job decline since 2023. Still, traders saw soft labor data as a green light for more Fed rate cuts. Overall — a bullish week, capped by dip-buying and momentum from cyclical sectors.

TLDR Stock Market Weekly Update - Oct 3, 2025

📉 Market Trends

Macro Tailwinds:

Seasonality flipped positive entering Q4, and investors expect a soft landing + rate cuts by year-end.

Treasury yields eased across the curve; 10-year yield fell to 4.10%.

GDP revised to 3.8% for Q2, confirming resilient U.S. growth.

Sector Rotation:

AI & Tech led early, but profit-taking hit mega-caps late week.

Cyclicals and Industrials gained traction, hinting at broadening participation.

Energy pulled back, down ~2%, on OPEC+ production headlines.

📊 Technical Levels & Market Signals

S&P 500 (SPX): Bounced once again off the 20-day SMA and closed at a new record near 6,750. The trend remains intermediate-term bullish, though the RSI at 72 signals near-term overbought conditions — historically a prelude to brief consolidation.

Semiconductors (SOX): Up ~5% this week, hitting new highs — but RSI reached 83, the most overbought since 2011. Traders eyeing potential short-term pullback before resumption of uptrend.

🏛️ Economic Data, Rates & the Fed

ADP Employment: -32K vs +54K expected — largest drop since 2023.

ISM Manufacturing: 49.1 (7th straight contraction month).

ISM Services: Fell to 50.0 from 52.0.

Consumer Confidence: 94.2 vs 97.0 est — lowest since April.

Yields: 10-year at 4.10%, 2-year at 3.56%.

Rate Cut Odds: 97% chance of an October cut, 86% for December.

Markets continue to bet on two more rate cuts in 2025, supported by softer labor data and easing inflation expectations.

Sources: Charles Schwab

📅 Coming up next week…

Economic Events:

Tue (10/7): Trade Balance, Consumer Credit

Wed (10/8): EIA Crude Inventories, MBA Mortgage Apps

Thu (10/9): Jobless Claims, Wholesale Inventories

Fri (10/10): Michigan Consumer Sentiment

Notable Earnings Reports:

Mon (10/6): STZ, AEHR

Thu (10/9): DAL, PEP, LEVI, TLRY

Sources: Earnings Whispers, Charles Schwab

| CRWV $134.79

|

| PFE $27.37

|

| RGTI $40.06

|

🗞️ Market movers you might’ve missed:

- Taiwan Semiconductor Manufacturing Co Ltd ($TSMC) TSMC stock target raised at Morgan Stanley on expected earnings beat

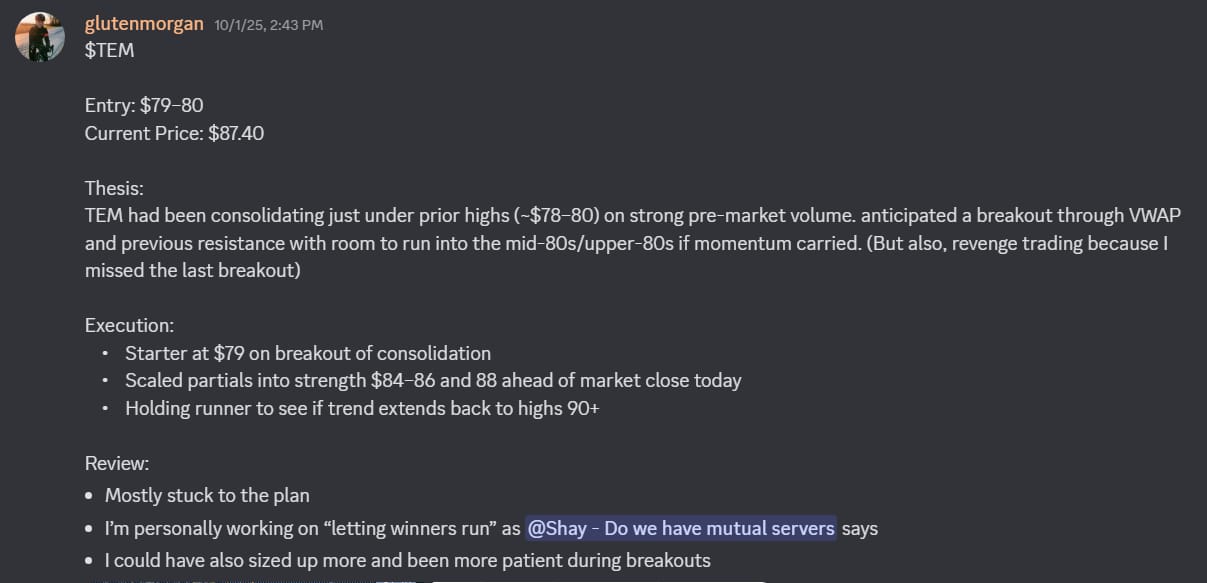

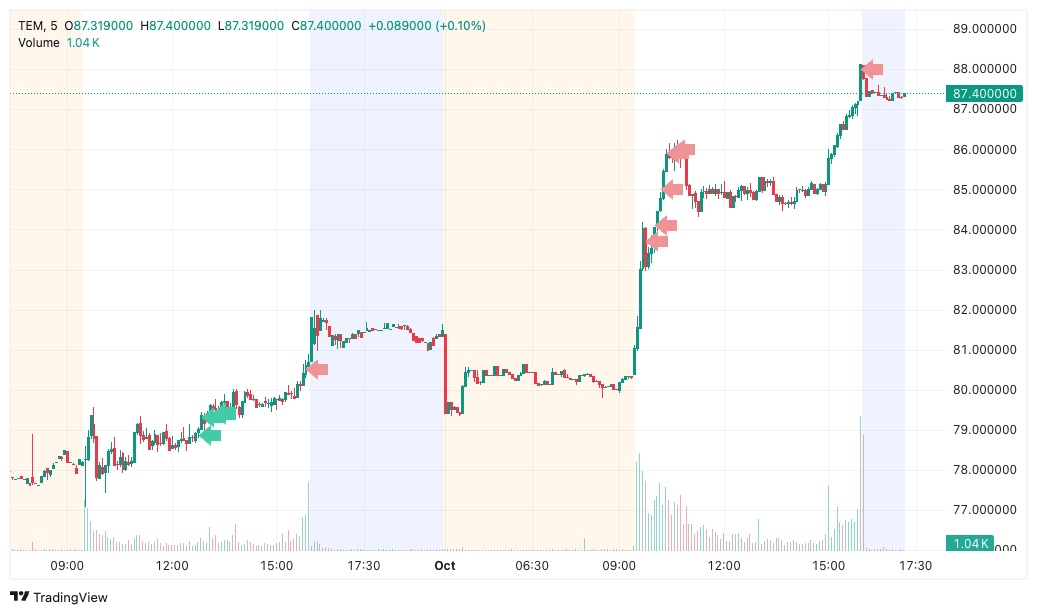

- How we traded: Gap Up Reversal Long Strategy

- CoreWeave Inc ($CRWV) CoreWeave Stock Soars on $14 Billion Meta Deal -- Wall Street Says the Nvidia-Backed AI Stock Is Still a Buy.

- How we traded: Backside Long Strategy

Ready to Elevate Your Trading this year?

Check out the Humbled Trader community!

Trade alongside and engage in market discussions with like-minded traders, and learn from our team of experienced trading coaches.

Your success story could be featured in one of our next “Top Trades of the Week” showcases! Learn more about our community and what we offer by clicking the button below.

Our Recommended Trading Tools:

Premium broker for large accounts: Centerpoint Securities

Best overall trading broker: Interactive Brokers

Best web-based charting platform: TradingView

Best trading journal with backtesting: Tradezella

Best scanner for active traders: Trade Ideas (Download my settings)

Not sure how to select a tool that fit your needs? Reply to this email with your trading style, and we will be happy to help!

Email Disclaimer:

The Watchlist Emails are NOT trade alerts to buy or sell. We are not financial advisers. The above information is for educational and entertainment purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. We are merely sharing our opinion with no guarantee of gains or losses on investments. You accept our Terms and Conditions.