- Humbled Trader

- Posts

- Tariff Tensions Rise, BTC Hits $122K, Big Tech Earnings Ahead- Weekend Watchlist

Tariff Tensions Rise, BTC Hits $122K, Big Tech Earnings Ahead- Weekend Watchlist

Humbled Trader's day trading & swing trading ideas

Markets continued to grind higher, defying last week’s “Slightly Bearish” call. The S&P 500 rose 0.50% and touched another all-time intraday high (6,315). While there was some "sell the news" action from big banks and Netflix after earnings beats, tech leadership (especially Nvidia) kept the rally alive.

Key headlines:

- Trade tensions rising – Trump threatened a 100% secondary tariff on Russia and 15–20% tariffs on the EU.

- Nvidia resumed AI chip sales to China, pushing the stock (and semiconductors) to fresh highs.

- Mid-week volatility emerged after Trump considered firing Fed Chair Powell; he later backtracked, calming markets.

Bitcoin also surged to a record high of $122,838, fueled by positive U.S. crypto regulatory developments.

TLDR Stock Market Weekly Update - July 18, 2025

📉Market Trends

Earnings Season: Early reports (+5% revenue, +10% EPS) are strong, but high-flyers often see “sell the news” reactions.

Tariff Jitters: August 1 deadline and escalating threats weigh on sentiment.

Crypto Boom: BTC and ETH both hit 2025 highs amid regulatory tailwinds.

📊 Technical Levels & Market Signals

S&P 500 (SPX): Closed at 6,291; new highs but negative RSI divergence suggests slowing momentum.

Nasdaq 100 (NDX): Also set fresh highs but with waning momentum ahead of key mega-cap earnings.

Market Breadth: Contracted week-over-week (SPX breadth down to 60.9% from 64.6%), showing narrow leadership.

💰Economic Data, Rates & the Fed

CPI: +0.3% MoM headline (vs. +0.2% est.), +2.7% YoY in line.

PPI: Flat MoM (vs. +0.2% est.), +2.3% YoY (below +2.5% est.).

Retail Sales: Stronger at +0.6% MoM (vs. +0.1% est.).

Jobless Claims: Fell to 221K (lowest since April).

Fed Rate Cut Odds: Slightly lower; Sept cut chance down to 64% (from 70%).

🏛️ Cryptocurrency News

Bitcoin hits $122,838, Ethereum surges past $3,600 as U.S. crypto legislation advances:

- GENIUS Act (stablecoins) headed to Trump’s desk.

- CLARITY Act and Anti-CBDC Act passed House, now in Senate.

Sources: Charles Schwab

📅 Coming up next week…

Economic Events:

Mon (7/21): Leading Indicators

Tue (7/22): No reports

Wed (7/23): Crude Oil Inventories, Existing Home Sales, MBA Mortgage Apps

Thu (7/24): Jobless Claims, New Home Sales, S&P Global PMIs, Philly Fed Index

Fri (7/25): Durable Goods Orders

Notable Earnings Reports:

Mon (7/21): CLF, DPZ, VZ

Tue (7/22): KO, RTX, SAP, TXN

Wed (7/23): GOOGL, TSLA, IBM, TMUS, BAC, JNJ, QS, T, HAS

Thu (7/24): AAL, TSM, GE, NFLX, INTC, HON

Fri (7/25): CNC

Sources: Earnings Whispers, Charles Schwab

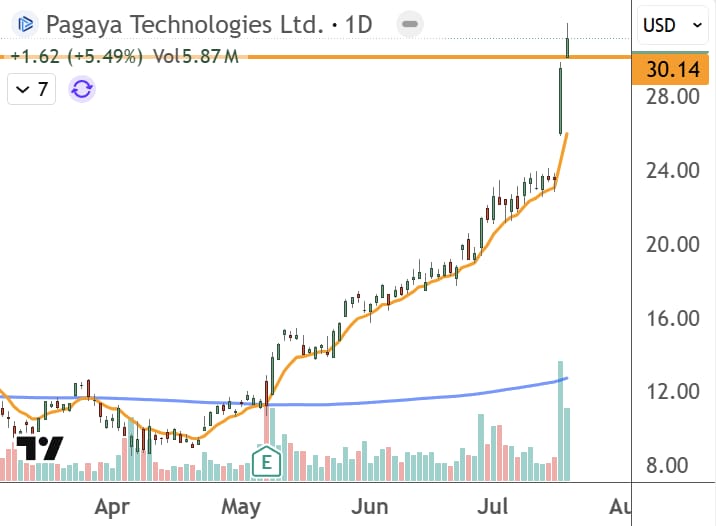

| PGY $30.14

|

| QS $14.64

|

| BULL $16.89

|

🗞️ Market movers you might’ve missed:

- Taiwan Semiconductor Manufacturing Co Ltd ($TSM) Taiwan Semiconductor Q2 EPS $2.47 Beats $2.37 Estimate, Sales $30.07B Beat $30.04B Estimate

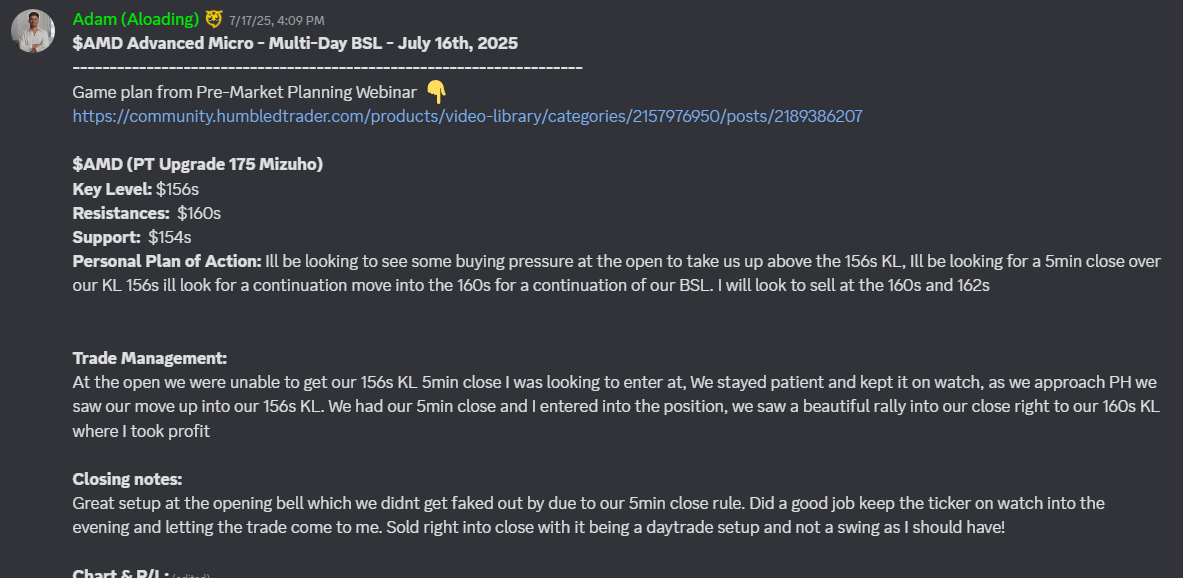

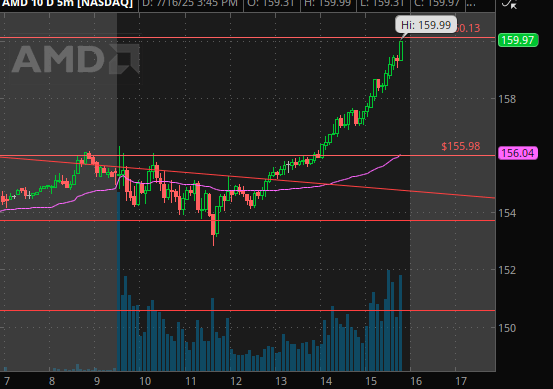

- How we traded: Gap Up Reversal Long Strategy

- Coinbase Global Inc. ($COIN) Shares of Robinhood and Coinbase shares are trading higher following reports indicating President Trump is set to open the US retirement plans to crypto investments. Additionally, the US House passed the CLARITY Act on Thursday.

- How we traded: Backside Long Strategy

Ready to Elevate Your Trading this year?

Check out the Humbled Trader community!

Trade alongside and engage in market discussions with like-minded traders, and learn from our team of experienced trading coaches.

Your success story could be featured in one of our next “Top Trades of the Week” showcases! Learn more about our community and what we offer by clicking the button below.

How to Build Trading Systems that Work: Stocks, Futures & Forex Ft. Rayner Teo

In this episode, we sit down with Rayner Teo to explore how he went from discretionary trading to building robust algorithmic systems across stocks, ETFs, forex, and commodities.

Discover why Rayner believes in diversification through multiple trading systems, how he identifies which systems to trade each month, and the advantages of being a systems trader vs a discretionary trader.

Whether you're a beginner trader or an experienced one looking to scale with automation, this episode is packed with insights on systematic trading, risk management, and creating a trading business that supports your life.