- Humbled Trader

- Posts

- Tech Pullback or Trend Reversal? All Eyes on Nvidia- Weekend Watchlist

Tech Pullback or Trend Reversal? All Eyes on Nvidia- Weekend Watchlist

Defensive sectors take the lead as AI stocks wobble — plus what to expect ahead of NVDA’s make-or-break earnings.

Markets were choppy this week as tech and AI stocks came under pressure, triggered by cautious Fed commentary and rising skepticism about the pace of AI spending. The S&P 500 started strong—up nearly 2% mid-week—before reversing lower as investors reacted to Michael Burry’s post questioning data-center valuations, which re-ignited fears of an AI bubble. Tech weakness contrasted with strength in Healthcare, Staples, Materials, and Energy, signaling another rotation into defensives.

A brief U.S. government shutdown ended, but it delayed key economic reports, leaving traders flying partially blind ahead of next week’s mega catalyst: Nvidia earnings. With sentiment shaky and VIX elevated near 20, the market ended the week cautious but holding above key support levels.

TLDR Stock Market Weekly Update - November 14, 2025

📉 Market Trends

Rotation into Defensive Sectors: AI/tech sold off after valuation concerns resurfaced. Healthcare, Consumer Staples, Energy, and Materials led the market.

Government Shutdown Ends: The temporary shutdown delayed key data releases, reducing visibility for traders.

All Eyes on Nvidia: Nvidia’s Wednesday report is likely the defining event of the week ahead. Options are pricing a large swing — this could shape the next major trend in tech.

📊 Technical Levels & Market Signals

S&P 500 (SPX): Pulled back but held the 50-day MA, a critical support level. Early bounce suggests dip buyers remain active. Near-term read: Slightly Bullish, assuming this support holds.

Nasdaq Composite (COMP): Still heavily influenced by tech weakness. Trading just above support — a failed bounce could break the trend. Near-term read: Neutral → Cautious until Nvidia earnings.

Volatility (VIX): Hovering near 20, indicating traders expect larger price swings.

💰 Economic Data, Rates & the Fed

Limited data due to the shutdown, but Fed tone leaned cautious.

Concerns remain that rate cuts may be driven by economic weakness, not strength.

Treasury yields dipped mid-week before stabilizing.

Key delayed data points that typically move markets:

CPI & PPI

Nonfarm Payrolls

Retail Sales

Sources: Charles Schwab

📅 Coming up next week…

Economic Events:

Tue (Nov 18): CPI

Wed (Nov 19): PPI, Retail Sales

Thu (Nov 20): Jobless Claims, Housing Starts

Fri (Nov 21): Existing Home Sales, Leading Index

Notable Earnings Reports:

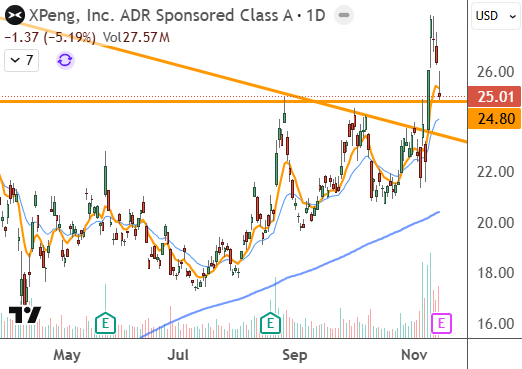

Mon (Nov 17): XPEV

Tue (Nov 18): HD, BIDU, PDD

Wed (Nov 19): TGT, WIX, NVDA, PANW

Thu (Nov 20): WMT, BULL, INTU, GAP

Sources: Earnings Whispers, Charles Schwab

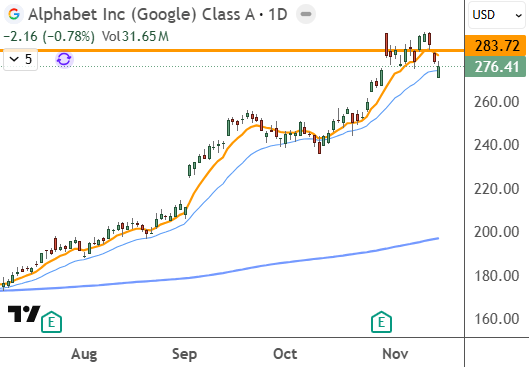

| GOOGL $276.41

|

| XPEV $25.01

|

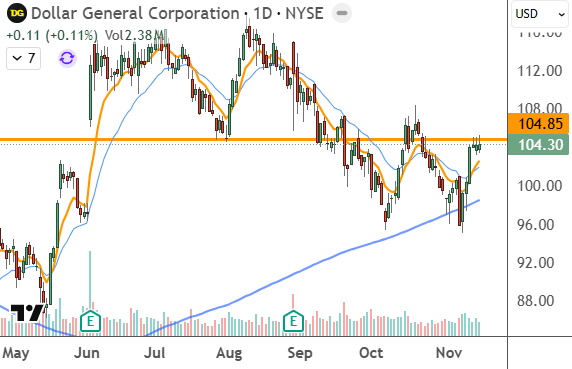

| DG $104.30

|

🗞️ Market movers you might’ve missed:

- Warner Bros Discovery Inc ($WBD) Warner Bros. Discovery shares are trading higher after a Wall Street Journal report said Paramount, Comcast and Netflix are among potential bidders.

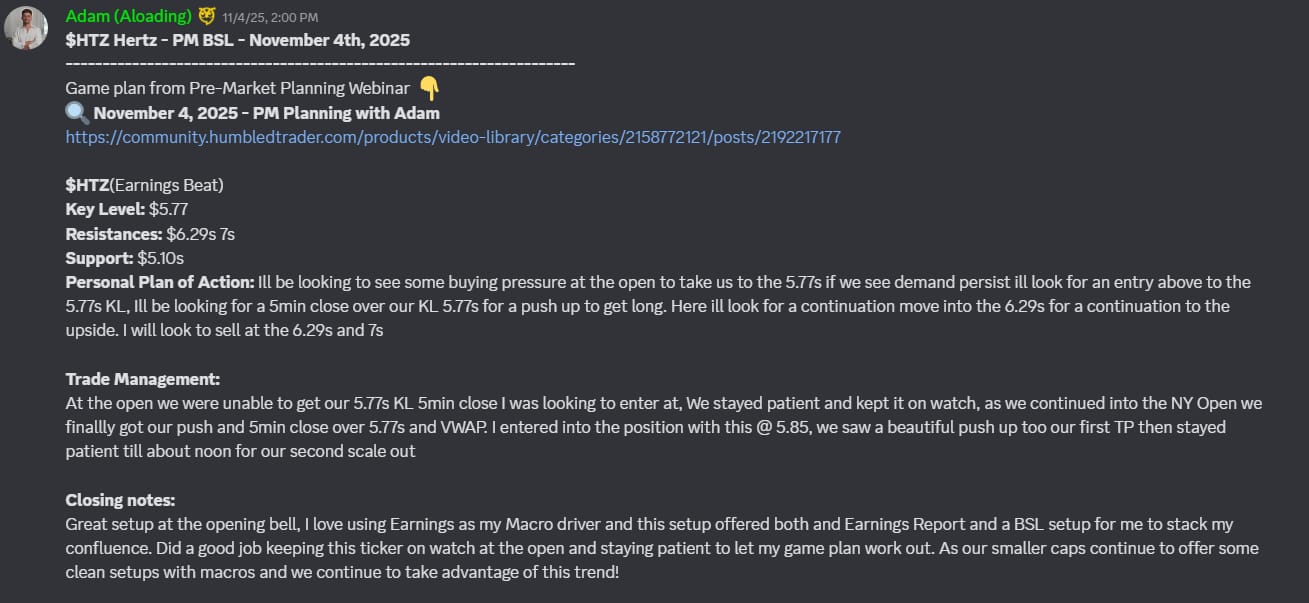

- How we traded: Backside Long Strategy

- Dollar General Corp ($DG) Dollar General Appoints Emily C. Taylor as COO

- How we traded: Backside Long Strategy

Ready to Elevate Your Trading this year?

Check out the Humbled Trader community!

Trade alongside and engage in market discussions with like-minded traders, and learn from our team of experienced trading coaches.

Your success story could be featured in one of our next “Top Trades of the Week” showcases! Learn more about our community and what we offer by clicking the button below.

Our Recommended Trading Tools:

Premium broker for large accounts: Centerpoint Securities

Best overall trading broker: Interactive Brokers

Best web-based charting platform: TradingView

Best trading journal with backtesting: Tradezella

Best scanner for active traders: Trade Ideas (Download my settings)

Not sure how to select a tool that fit your needs? Reply to this email with your trading style, and we will be happy to help!

Email Disclaimer:

The Watchlist Emails are NOT trade alerts to buy or sell. We are not financial advisers. The above information is for educational and entertainment purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. We are merely sharing our opinion with no guarantee of gains or losses on investments. You accept our Terms and Conditions.