- Humbled Trader

- Posts

- 🚨Tech Stumbles, Markets Hold the Line — Here’s What Really Happened

🚨Tech Stumbles, Markets Hold the Line — Here’s What Really Happened

SPX fights to stay above support as breadth sinks and AI names wobble. Your full weekly breakdown inside.

🚀Black Friday Sale: My Favorite Trading Tools

Web-based charting platform I use for my weekend watchlist planning.

My day trading & swing trading scanner

You can download my Trade Ideas scanner settings here.

Use code: HUMBLED25 to get 25% off all plans

Use code: HUMBLED30 to get 30% off annual premium plan

Affiliate disclosure: All the recommendations above are products I personally pay for and use daily for trading. At no extra cost to you, I earn a small commission if you subscribe.

Markets bounced today on improved hopes for a rate cut, but the week is still on track for a loss (~1.3%) as selling pressure hit tech & AI names. The major indices closed below their 50-day SMAs for the first time since April.

Despite a strong earnings beat from NVIDIA Corporation, investors were more concerned about debt-financed AI build-outs and stretched valuations.

Economic data resumed after the U.S. government shutdown, but the labour market remains patchy and breadth has deteriorated.

TLDR Stock Market Weekly Update - Nov 21, 2025

📉 Market Trends

Tech & AI under pressure as “over-investment” concerns surface despite strong earnings.

Renewed rate-cut hopes spurred today’s intraday recovery (NY Fed President’s dovish commentary).

Market breadth hit multi-month lows (S&P, Nasdaq, Russell) as fewer stocks are rallying.

📊 Technical Levels & Market Signals

S&P 500 (SPX): Broke below its 50-day SMA — a notable shift in trend behaviour. Found near-term support at the 100-day SMA during today’s rebound. Technical translation: Intermediate-term still bullish (trend intact), but near-term cautious/tentative.

Nasdaq Composite (COMP): Heavy tech weighting means much of the weakness is tech-driven. RSI and momentum signals are showing signs of strain — consolidation is likely.

💰 Economic Data, Rates & the Fed

The labour market remains murky post-shutdown: mixed signals from Non-farm Payrolls and other reports.

Fed outlook: market still sees rate cut possibility, but probabilities have fallen — data dependency emphasized.

Treasury yields are slightly lower today but remain range-bound amid uncertainty.

With data lagging (shutdown impact), the Fed faces a “data desert” going into year end.

🏛️ Cryptocurrency News

Crypto markets remain under pressure alongside tech weakness; risk asset flows are cautious.

Safe-haven flows may benefit gold or other non-tech assets in the near term.

Sources: Charles Schwab

📅 Coming up next week…

Economic Events:

Tue (11/25): Consumer Sentiment, Durable Goods

Wed (11/26): Trade Balance, GDP (Advanced)

Thu (11/27): U.S. Markets Closed – Thanksgiving

Notable Earnings Reports:

Mon (11/24): ZM, SYM

Tue (11/25): BABA, NIO, ANF, BBY, DELL, ADSK, AMBA, CLSK

Sources: Earnings Whispers, Charles Schwab

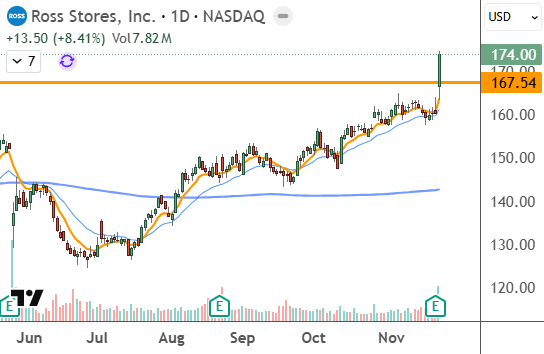

| ROST $174

|

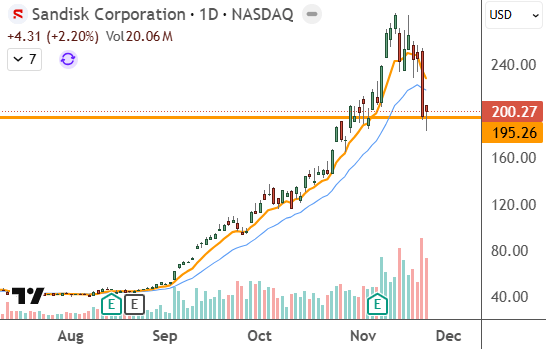

| SNDK $200.27

|

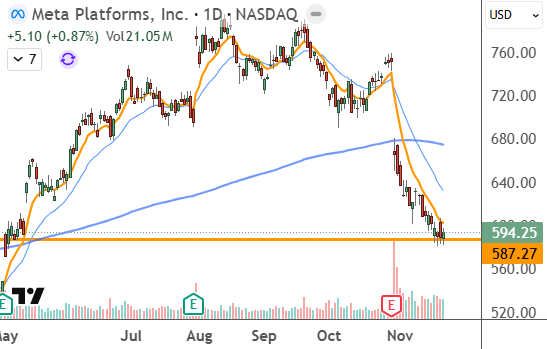

| META $594.25

|

🗞️ Market movers you might’ve missed:

- Gap Inc. ($GAP) Gap Jumps On Q3 Beat, Higher FY25 Sales Outlook.

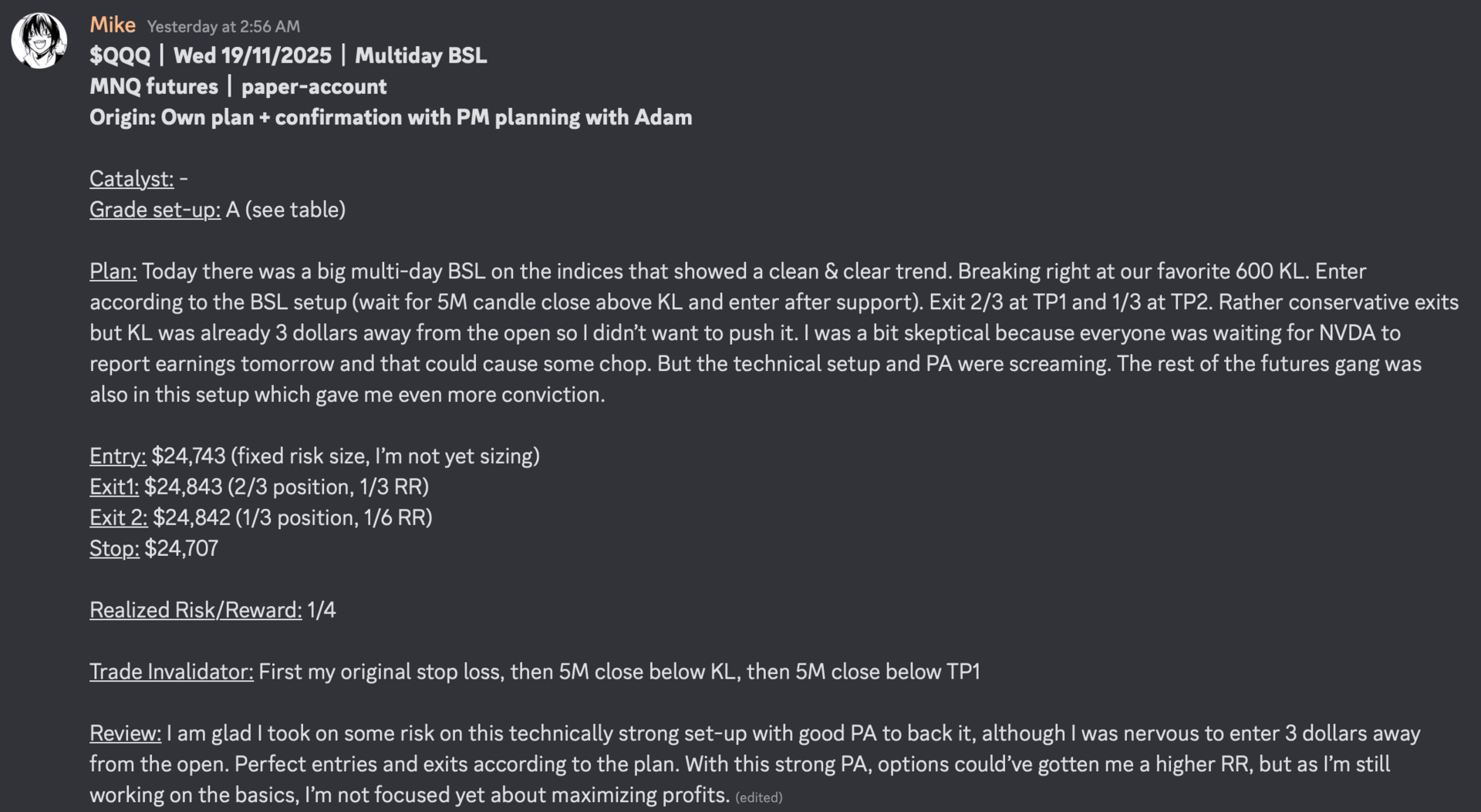

- How we traded: Backside Long Strategy

- Alphabet Inc Class A ($GOOGL) Berkshire reveals $4.3B stake in Alphabet.

- How we traded: Gap Up Reversal Long Strategy

Ready to Elevate Your Trading this year?

Check out the Humbled Trader community!

Trade alongside and engage in market discussions with like-minded traders, and learn from our team of experienced trading coaches.

Your success story could be featured in one of our next “Top Trades of the Week” showcases! Learn more about our community and what we offer by clicking the button below.

Email Disclaimer:

The Watchlist Emails are NOT trade alerts to buy or sell. We are not financial advisers. The above information is for educational and entertainment purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. We are merely sharing our opinion with no guarantee of gains or losses on investments. You accept our Terms and Conditions.