- Humbled Trader

- Posts

- 📊Trade Tensions Return: Markets Slip After a Record-Setting Week- Weekend Watchlist

📊Trade Tensions Return: Markets Slip After a Record-Setting Week- Weekend Watchlist

Humbled Trader's day trading & swing trading ideas

Hi !

The Biggest Winner Simulated Trading Competition is officially live!

Traders across Canada are competing for over $40,000 in cash prizes, including the $20,000 grand prize.

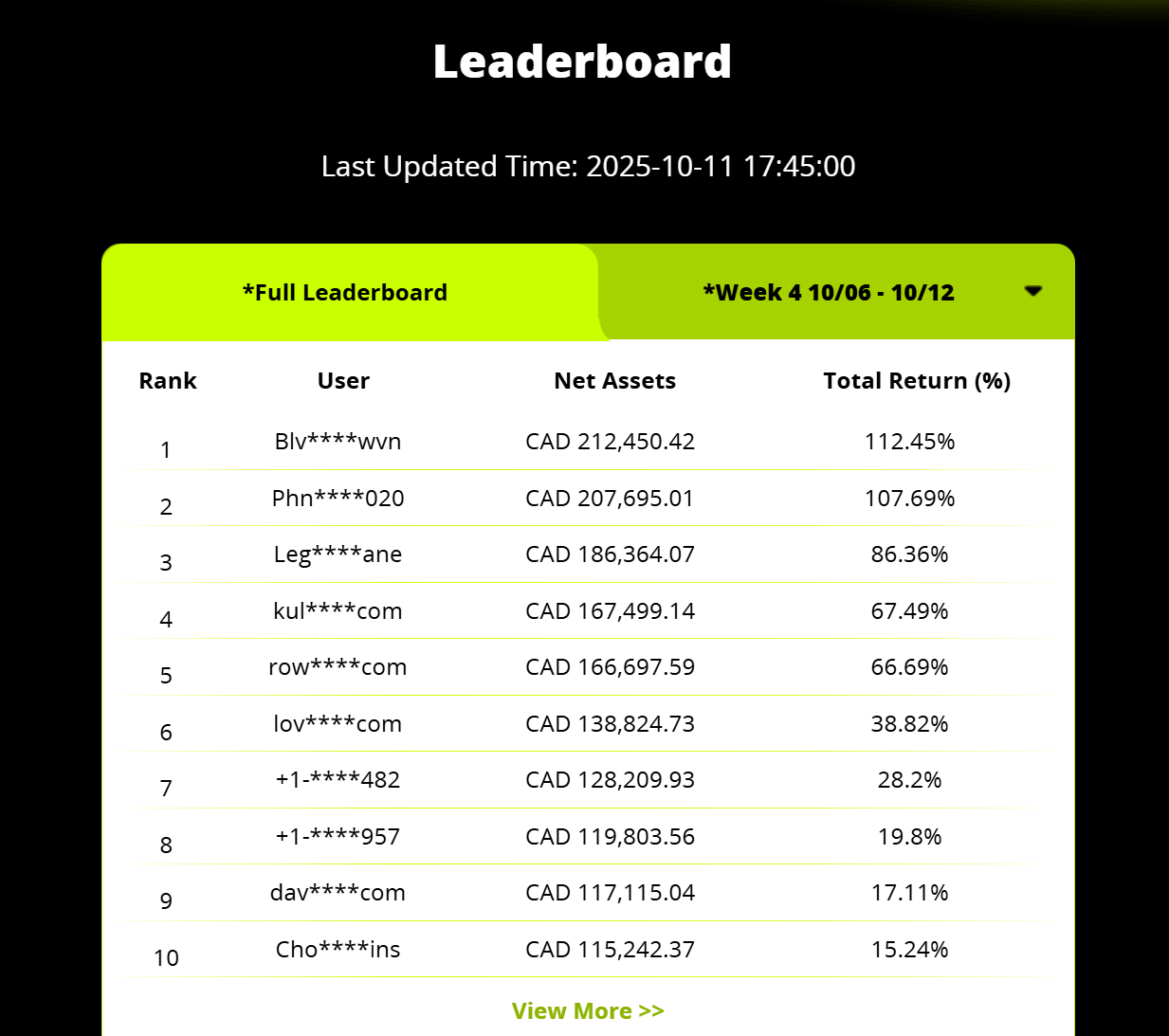

👀 Here’s a quick look at the current leaderboard:

Leaderboard as of Oct 11, 2025

But don’t worry — it’s still anyone’s game. With your $100,000 fantasy funds, one strong trade can shoot you up the rankings.

✅ Weekly prizes + random draws mean you can win even if you’re not at the top.

✅ All trading is risk-free — it’s a simulated account, no real money required.

✅ Competition will run until Oct 24, 2025

Don’t sit on the sidelines. Compete for FREE with thousands of traders across Canada and show us what you’ve got!

DISCLAIMER AT BOTTOM OF EMAIL

Stocks hit fresh all-time highs early in the week before a sharp Friday sell-off erased gains, driven by escalating U.S.–China trade tensions. Trump’s announcement of a potential “massive increase in tariffs” on Chinese imports sparked profit-taking, particularly in tech and semiconductors, following weeks of relentless momentum. China retaliated by expanding export restrictions on rare-earth minerals and semiconductor materials, tightening the screws on the global supply chain.

Despite the pullback, bullish sentiment rose to 45.9% (AAII survey) and breadth remains solid. The ongoing U.S. government shutdown—now in its 10th day—has yet to dent investor optimism, though political gridlock adds to short-term uncertainty.

TLDR Stock Market Weekly Update - October 10, 2025

📉Market Trends

U.S.–China trade tensions reignite; tariff escalation threatens tech supply chains.

Semiconductor stocks (SOX) swung wildly — gapping higher early, then reversing 2% midweek.

Government shutdown continues with layoffs in Education and Health departments.

Investors remain optimistic; bullish sentiment above long-term averages.

📊 Technical Levels & Market Signals

S&P 500 (SPX):

Set intraday record before Friday’s 2% pullback.

Short-term RSI elevated but trend remains intermediate-term bullish.

Nasdaq Composite (COMP):

Pulled back from new highs amid tech weakness; momentum cooling.

Still above key moving averages — trend intact unless selling deepens.

Semiconductors (SOX):

RSI remains overbought after hitting 14-year highs; high volatility persists.

Traders watching for mean reversion after months of parabolic gains.

💰 Economic Data, Rates & the Fed

ADP Employment: -32K — largest drop since 2023.

ISM Manufacturing: 49.1 (7th straight contraction).

Consumer Confidence: 94.2 (lowest since April).

Yields: Slightly lower across curve; 10-year near 4.1%.

Fed Outlook: Markets still pricing in two more 25bp cuts in 2025; expectations for October cut rise to 97%.

Sources: Charles Schwab

📅 Coming up next week…

Economic Events:

Tue (10/14): PPI, Small Business Optimism

Wed (10/15): CPI, Retail Sales, Fed Minutes

Thu (10/16): Jobless Claims, Industrial Production

Fri (10/17): Consumer Sentiment

Notable Earnings Reports:

Tue (10/14): BLK, JPM, C, WFC, JNJ, DPZ

Wed (10/15): ASML, DLTR, BAC, MS, UAL

Thu (10/16): TSM, IBKR, CSX

Fri (10/17): ALLY

Sources: Earnings Whispers, Charles Schwab

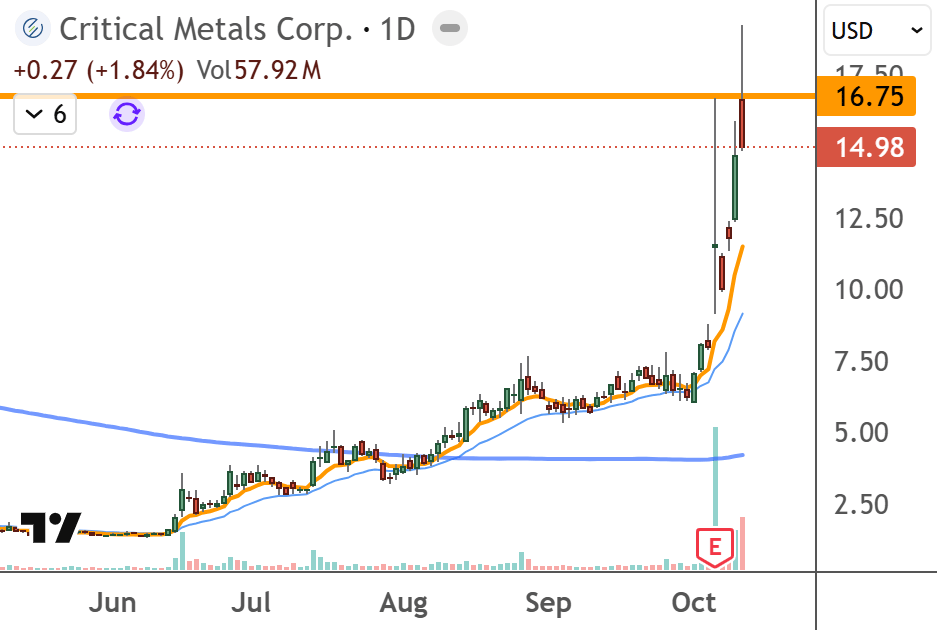

| CRML $14.98

|

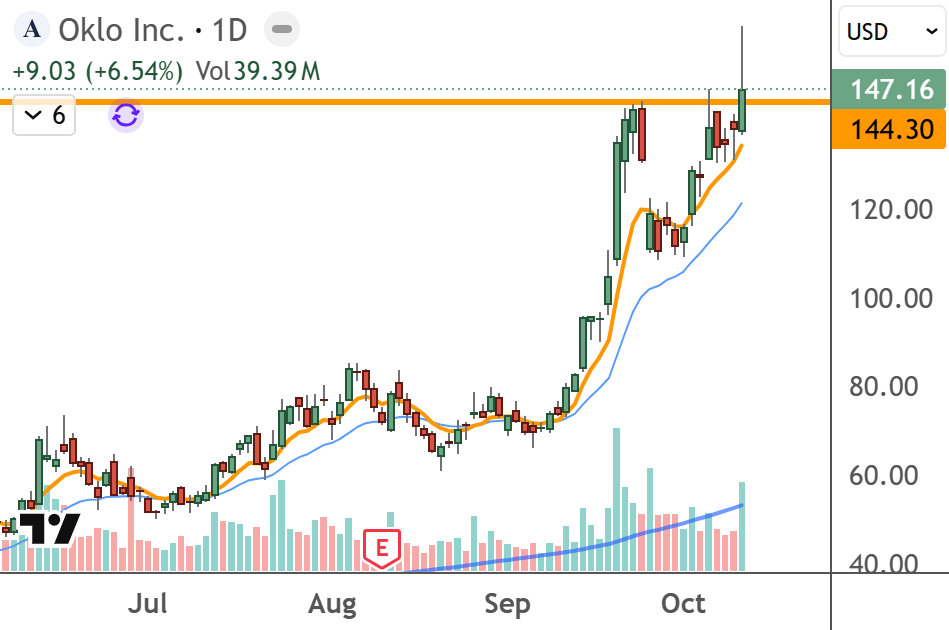

| OKLO $147.16

|

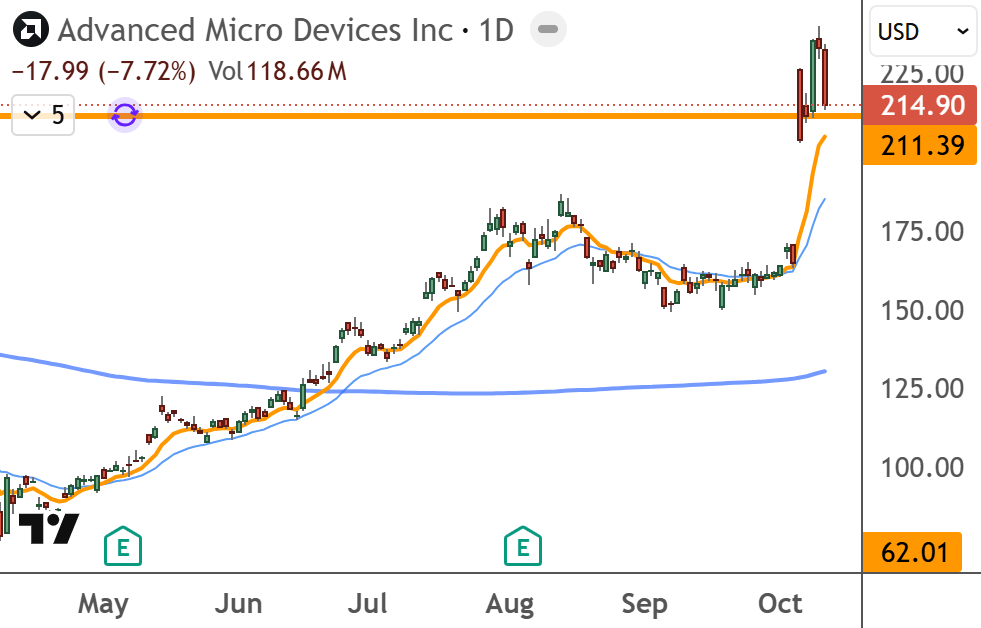

| AMD $214.9

|

🗞️ Market movers you might’ve missed:

- Advanced Micro Devices Inc ($AMD) AMD shares are trading higher after the company announced a multi-year partnership with OpenAI to deploy 6 Gigawatts of AMD GPUs.

- How we traded: Gap Up Reversal Long

- CoreWeave Inc ($CRWV) CoreWeave Launches Serverless RL, A Fast And Easy Way To Train AI Agents Using Reinforcement Learning.

- How we traded: Backside Long Strategy

Ready to Elevate Your Trading this year?

Check out the Humbled Trader community!

Trade alongside and engage in market discussions with like-minded traders, and learn from our team of experienced trading coaches.

Your success story could be featured in one of our next “Top Trades of the Week” showcases! Learn more about our community and what we offer by clicking the button below.

This email has been paid for in part by Global X Investments Canada Inc.

Commissions, management fees and expenses all may be associated with an investment in products (the "Global X Funds") managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their value changes frequently and past performance may not be repeated. Certain Global Funds may have exposure to leveraged and inverse leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The prospectus contains important detailed information about the ETF. Please read the relevant prospectus before investing.

The Global X Funds include our BetaPro products (the “BetaPro Products”). The BetaPro Products are alternative mutual funds within the meaning of National Instrument 81-102 Investment Funds and are permitted to use strategies generally prohibited by conventional mutual funds: the ability to invest more than 10% of their net asset value in securities of a single issuer, to employ leverage, and engage in short selling to a greater extent than is permitted in conventional mutual funds. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value.

The BetaPro Products consist of our Daily Bull and Daily Bear ETFs (the “Leveraged and Inverse Leveraged ETFs”), Inverse ETFs (the “Inverse ETFs”), and our BetaPro S&P 500 VIX Short-Term Futures™ ETF (the “VIX ETF”) and can offer opportunities for enhanced returns or hedging strategies, but it’s essential to understand and accept the associated risks. Leveraged ETFs aim to amplify the returns of an underlying index, which can lead to higher gains, but they also magnify losses in downturns. Similarly, inverse ETFs seek to profit from declines in the underlying index, meaning they can perform inversely to the market, but losses can accumulate quickly if the market moves against expectations. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. Investors should be aware of and understand their risk tolerance and capacity and conduct their research before investing.

The BetaPro Products include the 3x and -3x ETFs and will use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. These 3x and -3x ETFs are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their prospectus. Each 3x and -3x ETF seeks a return, before fees and expenses, that is equal to either 300% or –300% of the performance of a specified underlying index (the “Target”) for a single day. Due to the compounding of daily returns, a 3x and -3x ETF’s returns over periods other than one day will likely differ in amount and possibly direction from the performance of their respective Target(s) for the same period. Hedging costs charged to BetaPro Products reduce the value of the forward price payable to that ETF.

An investment in any of the BetaPro Products is not intended as a complete investment program and is appropriate only for sophisticated investors who have the capacity to absorb a loss of some or all of their investment.

Please read the full risk disclosure in the prospectus before investing. Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment(s) remain consistent with their investment strategies.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the "Global X Funds") managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

The views/opinions expressed herein are solely those of the author(s) and may not necessarily be the views of Global X Investments Canada Inc. All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Email Disclaimer:

The Watchlist Emails are NOT trade alerts to buy or sell. We are not financial advisers. The above information is for educational and entertainment purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. We are merely sharing our opinion with no guarantee of gains or losses on investments. You accept our Terms and Conditions.